Bond Information

Class A-1 Bonds

Stock code: V7AB

The bonds began trading on the SGX-ST Mainboard on 30 May 2022.

Identifiers

Stock Price

Class B Bonds

Stock code: V7BB

The bonds began trading on the SGX-ST Mainboard on 30 May 2022.

Identifiers

Stock Price

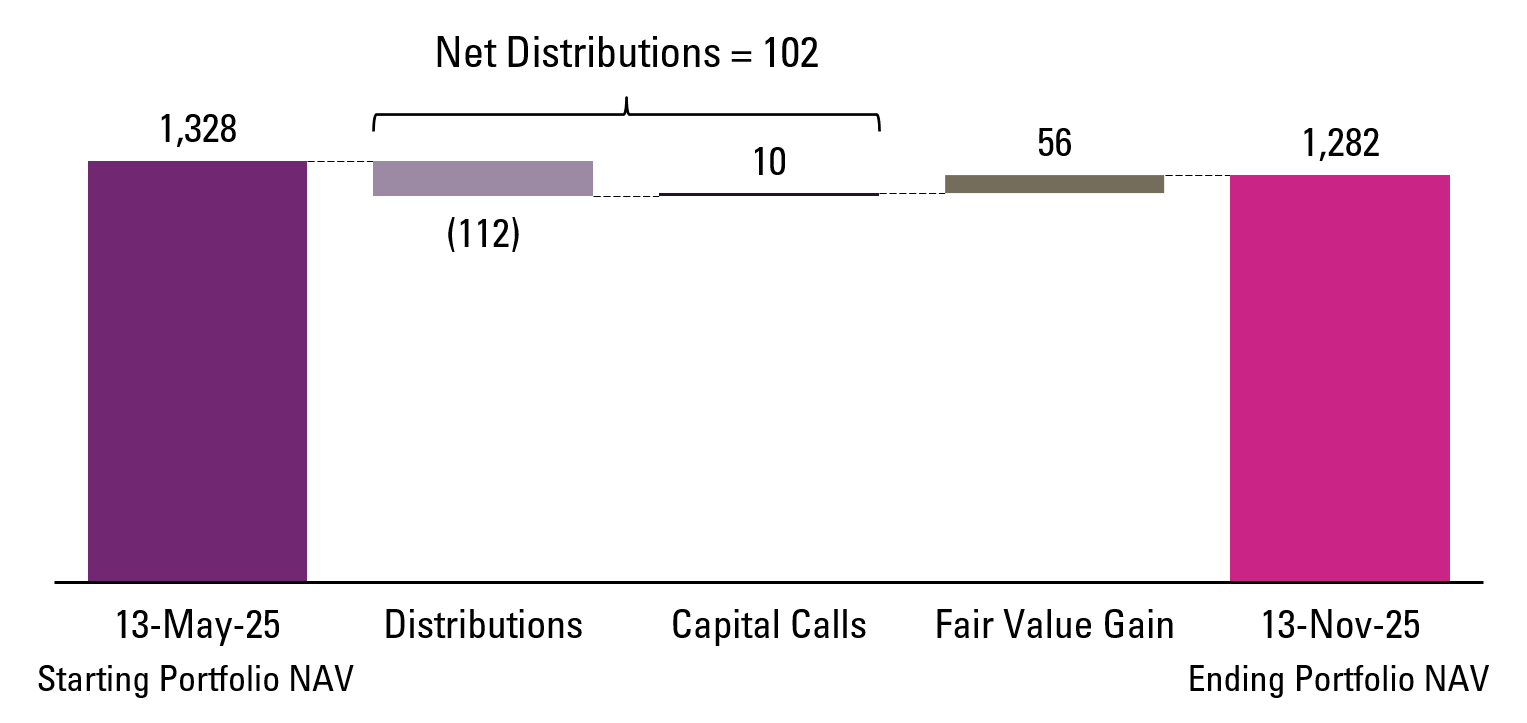

Portfolio Activity (US$)

For the latest Distribution Period, US$112m of distributions were received from the PE Funds while US$10m was invested through capital calls. The net distributions of US$102m were applied to the Priority of Payments. These cash flow and unrealised fair value movements resulted in an ending Portfolio NAV of US$1,282.

Outstanding Bonds

| Class | Class A-1 Bonds | Class A-2 Bonds | Class B Bonds |

|---|---|---|---|

| Principal Amount | S$526m (US$380m) | US$175m | US$200m |

| Interest Rate Per Annum | 4.125% | 5.35% | 6% |

| Interest Rate Step-Up Per Annum | 1.0% | 1.0% | 1.0% |

| Scheduled Call Date | 27 May 2027 | 27 May 2027 | 27 May 2028 |

| Maturity Date | 27 May 2032 | 27 May 2032 | 27 May 2032 |

| Ratings (Fitch / S&P)1 | A+sf / A+ (sf) | A+sf2 / Not rated | A-sf3 / Not rated |

Click the links to access the Fitch Rating Report as well as S&P's Final Ratings Press Release and S&P's Presale Report .

1 Fitch and S&P have not provided their consent, for the purposes of Section 249 of the SFA, to the inclusion of the information cited and attributed to them in the Prospectus, and are therefore not liable for such information under Sections 253 and 254 of the SFA (as described in the section “Credit Ratings”).

2 Rated Asf at launch, Class A-2 Bonds were upgraded to A+sf by Fitch on 19 Nov 2025. Click here for the press release.

3 Rated BBB+sf at launch, Class B Bonds were upgraded to A-sf by Fitch on 13 Feb 2024. Click here for the press release.

Videos

May 19, 2022

Astrea 7 Private Equity Bonds

May 31, 2018

What are Private Equity Bonds?

May 19, 2022

Astrea 7 Private Equity Bonds – Chinese Subtitles

May 31, 2018

What are Private Equity Bonds? - Chinese Subtitles

May 19, 2022

Part 1 – Introduction – Astrea 7 Management Presentation

May 19, 2022

Part 2 – About Azalea – Astrea 7 Management Presentation